The global wine industry represents one of the world’s most enduring and sophisticated agricultural sectors, with a rich history spanning thousands of years. From ancient civilizations that first cultivated grapes to modern vineyards employing cutting-edge technology, wine production has evolved into a complex ecosystem worth hundreds of billions of dollars annually.

The global wine industry, a sophisticated sector worth approximately $370 billion, combines traditional practices with modern technology across various producers, from small family-owned vineyards to large corporations. As consumer preferences evolve, particularly among younger generations valuing sustainability and premium products, the industry adapts by embracing innovations like precision viticulture and direct-to-consumer sales. Environmental factors, economic pressures, and regulatory challenges shape market dynamics, while the future growth trajectory remains promising, emphasizing quality, unique experiences, and authenticity.

This multifaceted industry encompasses everything from small family-owned vineyards to massive commercial operations, each contributing to a market that serves millions of consumers worldwide. The sector’s influence extends far beyond agriculture, driving tourism, supporting local economies, and preserving cultural traditions across wine-producing regions.

Understanding the wine industry’s structure, challenges, and opportunities provides valuable insights for investors, entrepreneurs, and enthusiasts alike. As consumer preferences shift and new markets emerge, the industry continues to adapt while maintaining its fundamental commitment to quality and craftsmanship that has defined winemaking for millennia.

Table of Contents

Overview of the Global Wine Industry

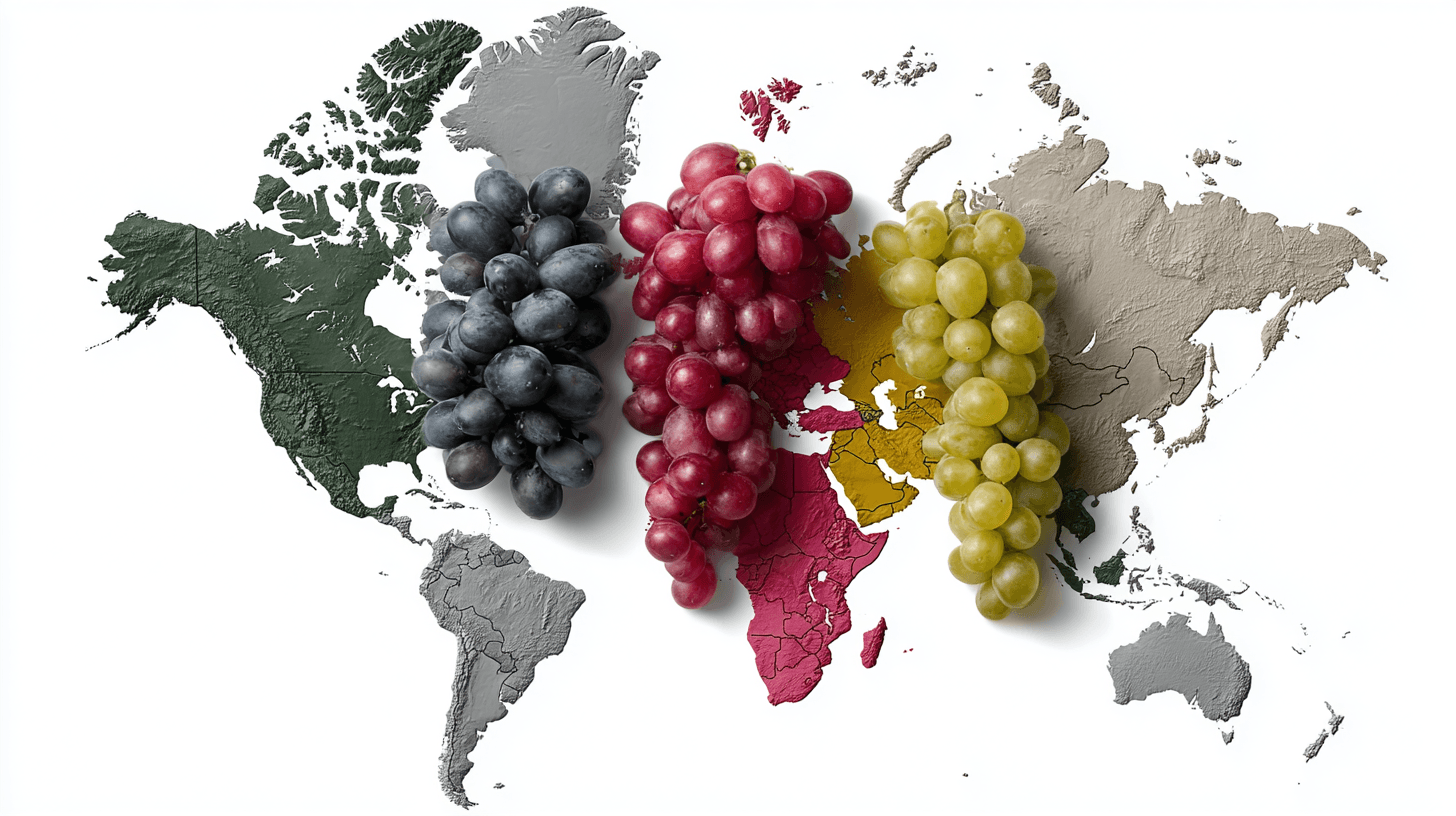

The global wine industry encompasses a vast network of producers, distributors, retailers, and consumers spanning six continents. Wine production reached 260 million hectoliters in 2024, with 57% originating from European vineyards. This ancient craft transforms grapes into products valued at approximately $370 billion annually, making it one of agriculture’s most economically significant sectors.

Current Market Dynamics and Production Scale

Wine production operates across 7.3 million hectares of vineyards worldwide, with Italy, Spain, and France commanding 46% of global vineyard area. The European Union maintains its position as the dominant producer, contributing 147 million hectoliters in 2024. However, emerging markets in South America, Asia, and Oceania have increased their combined production by 23% since 2020.

International wine trade reached $37.2 billion in 2024, representing a 12% increase from the previous year. France leads export revenues with $12.8 billion, followed by Italy at $8.9 billion and Spain at $3.4 billion. The United States, despite being the world’s fourth-largest producer, imports $6.9 billion worth of wine annually, making it the largest consumer market by value.

China’s wine consumption patterns have shifted dramatically, with domestic consumption dropping 31% since 2020 while premium wine imports increased 18%. This trend reflects changing consumer preferences toward quality over quantity, a pattern observed across multiple developing markets.

Regional Production Characteristics

European wine regions maintain traditional production methods while incorporating modern technology. French wine producers utilize precision viticulture techniques on 72% of their vineyards, combining satellite imagery with soil sensors to optimize grape quality. Italian producers have embraced sustainable farming practices, with 34% of vineyards certified organic as of 2024.

The New World wine regions demonstrate different production philosophies. Australian wine producers focus on mechanization and efficiency, with 89% of vineyards using mechanical harvesting compared to 31% in France. California’s wine industry emphasizes direct-to-consumer marketing, with 68% of wineries selling directly to consumers through tasting rooms and online platforms.

South American wine production has expanded beyond traditional markets. Chilean wine exports increased 15% in 2024, while Argentine wines gained recognition for high-altitude viticulture. These regions benefit from favorable climate conditions and lower production costs compared to European counterparts.

Consumer Behavior and Market Trends

Wine consumption patterns reveal significant generational differences. Millennials and Generation Z consumers purchase 42% of wine by volume but prefer premium products, spending 67% more per bottle than Baby Boomers. This demographic shift influences wine marketing strategies, with 78% of wineries increasing their social media presence in 2024.

The premiumization trend affects all market segments. Wines priced above $15 per bottle increased their market share by 8% in 2024, while wines under $10 lost 6% market share. This shift reflects consumers’ willingness to pay more for perceived quality and unique experiences.

Organic and biodynamic wines represent the fastest-growing segment, with sales increasing 28% annually. These products appeal to health-conscious consumers and environmental advocates, with 31% of wine buyers actively seeking sustainable options.

Distribution Channels and Market Access

Wine distribution operates through multiple channels, each serving distinct consumer segments. Traditional retail channels, including supermarkets and specialty wine shops, account for 67% of wine sales by volume. Online wine sales grew 43% in 2024, though they represent only 12% of total sales volume.

Direct-to-consumer sales provide wineries with higher profit margins, averaging 45% compared to 25% through traditional retail channels. Successful direct-to-consumer marketing requires investment in tasting rooms, wine clubs, and digital platforms. Smaller wineries particularly benefit from this model, as it allows them to compete with larger producers.

Wine tastings and events serve as crucial marketing tools, generating $2.8 billion in revenue annually. These experiences create emotional connections between consumers and brands, leading to increased loyalty and repeat purchases. Wineries that host regular events report 34% higher direct sales compared to those relying solely on traditional marketing.

Technological Innovation and Production Methods

Modern wine production integrates traditional techniques with advanced technology. Precision viticulture uses GPS-guided equipment and drone monitoring to optimize grape growing conditions. These technologies reduce water usage by 23% while maintaining grape quality standards.

Fermentation monitoring systems provide real-time data on temperature, pH levels, and sugar content. This information allows winemakers to make precise adjustments during production, resulting in more consistent wine quality. Large-scale producers report 18% reduction in batch variation using these systems.

Artificial intelligence applications analyze consumer preferences and market trends to guide production decisions. Some wineries use machine learning algorithms to predict optimal harvest timing and blending ratios. These tools help producers create wines that meet specific market demands while maintaining quality standards.

Economic Impact and Employment

The wine industry supports 5.2 million jobs globally, including agricultural workers, production staff, and service personnel. Wine tourism generates an additional $13.4 billion annually, supporting hospitality and transportation services in wine regions.

Wine production creates significant economic multiplier effects. Each dollar spent on wine production generates $2.67 in economic activity through supporting industries. This includes glass manufacturing, cork production, logistics services, and marketing agencies.

Regional economic impacts vary considerably. Napa Valley’s wine industry contributes $9.4 billion to California’s economy, while Bordeaux’s wine sector generates €4.2 billion for the French economy. These figures demonstrate wine’s importance beyond agricultural production.

Building Memorable Wine Brands

Brand development in the wine industry requires careful balance between tradition and innovation. Successful wine brands establish clear positioning based on origin, production methods, or target consumer segments. Brand recognition directly correlates with pricing power, with recognized brands commanding 35% higher prices than comparable unbranded wines.

Sensory branding plays a crucial role in wine marketing. Packaging design, label aesthetics, and tasting room experiences all contribute to brand perception. Research indicates that 67% of consumers form initial impressions based on label design, making visual branding essential for new wine introductions.

Brand authenticity becomes increasingly important as consumers seek genuine experiences. Wineries that emphasize their history, terroir, and production philosophy build stronger emotional connections with consumers. This authenticity translates into higher customer loyalty and word-of-mouth recommendations.

Public Relations and Credibility Building

Public relations efforts help winemakers establish credibility and build market recognition. Wine awards and critical reviews significantly influence consumer purchasing decisions, with 73% of wine buyers considering professional ratings when selecting wines. Participation in wine competitions provides valuable third-party validation.

Media relations focus on educating journalists and influencers about wine production processes and unique characteristics. Successful public relations campaigns emphasize storytelling, highlighting the people and places behind wine production. These stories create emotional connections that differentiate brands in crowded markets.

Industry partnerships and collaborations enhance credibility and expand market reach. Wineries that partner with restaurants, hotels, and other hospitality businesses gain access to new customer segments. These partnerships often lead to exclusive wine offerings and enhanced brand visibility.

Market Challenges and Adaptations

Climate change poses significant challenges to wine production, with traditional growing regions experiencing shifts in temperature and precipitation patterns. Bordeaux experienced its earliest harvest on record in 2024, reflecting warming trends that affect grape ripening schedules.

Water scarcity affects wine regions globally, with California implementing strict water usage regulations. Producers adapt through drought-resistant rootstocks, improved irrigation systems, and water recycling technologies. These adaptations increase production costs but ensure long-term sustainability.

Trade disputes and tariffs impact international wine markets. The ongoing trade tensions between major wine-producing and consuming countries create uncertainty for exporters. Producers diversify their market portfolios to reduce dependence on single export destinations.

Labor Market Dynamics

Skilled labor shortages affect wine production, particularly during harvest seasons. Experienced vineyard workers command premium wages, with seasonal labor costs increasing 19% in 2024. This shortage drives automation adoption and changes in vineyard management practices.

Winemaker education and training programs expand to meet industry demands. Viticulture and enology programs report 27% enrollment increases, reflecting growing interest in wine careers. These programs emphasize both traditional techniques and modern technology applications.

Succession planning challenges smaller family wineries, with 43% of wine businesses lacking clear succession plans. This situation creates opportunities for industry consolidation and new investment, but may also threaten traditional production methods and regional wine diversity.

Sustainability and Environmental Considerations

Environmental sustainability increasingly influences wine production decisions. Carbon footprint reduction initiatives include lightweight bottles, renewable energy systems, and organic farming practices. These efforts respond to consumer demand for environmentally responsible products.

Biodiversity conservation efforts protect vineyard ecosystems and surrounding habitats. Many wine regions implement cover cropping and integrated pest management to reduce chemical inputs. These practices improve soil health and support beneficial insects and wildlife.

Water conservation techniques become standard practice in water-stressed regions. Drip irrigation systems, soil moisture monitoring, and drought-resistant grape varieties help reduce water consumption. Some wineries achieve 40% water usage reduction through these methods.

Future Market Projections

Wine market analysts project continued growth in premium segments, with wines priced above $20 per bottle expected to increase market share by 15% through 2026. This growth reflects consumers’ willingness to pay for quality and unique experiences.

Emerging markets in Asia and Africa present significant growth opportunities. India’s wine consumption increased 22% in 2024, while Nigeria’s wine imports grew 31%. These markets favor premium products and represent substantial future revenue potential.

Alternative wine formats, including canned wines and wine-based cocktails, appeal to younger consumers and casual drinking occasions. These products grew 56% in 2024, though they represent a small fraction of total wine sales.

Investment and Consolidation Trends

Private equity investment in wine businesses reached $4.8 billion in 2024, representing a 23% increase from the previous year. Investors target wineries with strong brands, sustainable practices, and growth potential in emerging markets.

Consolidation activity affects both large and small wine producers. Large corporations acquire boutique wineries to expand premium portfolios, while small producers merge to achieve economies of scale. This trend may reduce wine diversity but improves financial stability for participants.

Real estate investment in wine regions reflects both agricultural and tourism value. Vineyard land prices increased 12% annually in premium regions, driven by both wine production potential and lifestyle appeal. These investments often include hospitality components to maximize returns.

Regulatory Environment and Compliance

Wine production faces complex regulatory requirements across jurisdictions. Labeling regulations, alcohol content standards, and import restrictions vary significantly between countries. Compliance costs represent 3-5% of production expenses for international wine businesses.

Alcohol taxation policies significantly impact wine pricing and consumption patterns. Tax increases in several European countries reduced wine consumption by 8% in 2024. Producers adapt through portfolio adjustments and pricing strategies to maintain profitability.

Food safety regulations require comprehensive quality control systems throughout wine production. These requirements increase operational costs but protect consumer safety and brand reputation. Compliance failures can result in product recalls and significant financial losses.

Digital Transformation and E-commerce

Digital platforms transform wine marketing and sales processes. E-commerce sales channels provide global market access for small producers, while data analytics help optimize marketing campaigns. Digital wine sales platforms report 34% year-over-year growth in 2024.

Social media marketing becomes essential for wine brand building. Instagram and TikTok platforms particularly influence younger wine consumers, with 58% of millennials discovering new wines through social media. Successful wineries invest in content creation and influencer partnerships.

Virtual wine tastings and online education programs expand market reach beyond traditional tasting rooms. These digital experiences became popular during the pandemic and continue growing, offering convenience and accessibility for wine enthusiasts.

Quality Standards and Certification Systems

Appellation systems and quality certifications provide consumer confidence and protect regional wine identities. These systems specify grape varieties, production methods, and geographic boundaries for wine production. Compliance ensures authenticity and supports premium pricing.

Organic and biodynamic certifications require strict adherence to natural production methods. These certifications appeal to health-conscious consumers and command premium prices. Certified organic wines sell for 20-30% more than conventional alternatives.

International wine competitions and rating systems influence consumer purchasing decisions and brand recognition. Wine awards provide third-party validation and marketing opportunities. Participation in prestigious competitions requires significant investment but offers substantial marketing benefits.

The global wine industry continues evolving through technological innovation, changing consumer preferences, and environmental challenges. Successful wine businesses adapt to these changes while maintaining the quality and authenticity that define exceptional wines. Understanding these dynamics helps industry participants navigate opportunities and challenges in this complex market.

Major Wine Producing Regions

Wine production centers across the globe exhibit distinct characteristics that shape their products and market positioning. These regions demonstrate the profound influence of geography, climate, and cultural traditions on winemaking practices and brand development strategies.

Old World vs New World Wine Markets

Old World wine regions encompass traditional European producers where winemaking techniques have evolved over centuries. France maintains its position as the world’s leading producer, generating 48 million hectoliters in 2023 and commanding over 20% of global production. French regions like Bordeaux and Burgundy have established appellation systems that protect geographical designations and maintain quality standards through strict regulatory frameworks.

Italy follows closely with 16.1% of global wine production, cultivating more than 400 grape varieties across 20 distinct regions. Italian producers focus on indigenous grape varieties such as Sangiovese, Montepulciano, and Nebbiolo, which reflect the country’s diverse terroir and regional winemaking traditions. The emphasis on terroir-driven production creates unique flavor profiles that distinguish Italian wines from other global offerings.

Spain contributes 13.6% to worldwide wine production while maintaining the largest vineyard acreage globally. Spanish producers have embraced organic farming practices more extensively than other major producers, positioning the country as the world’s largest organic wine producer. This commitment to sustainable agriculture aligns with growing consumer preferences for environmentally conscious products and provides Spanish wineries with distinct wine marketing strategies.

German wine regions demonstrate how Old World producers adapt traditional methods to modern market demands. German Rieslings showcase the potential for white wine production in cooler climates, creating wines with high acidity and complex mineral profiles. These characteristics appeal to sommeliers and wine enthusiasts who value precision and elegance over bold fruit flavors.

New World wine markets approach production with different philosophies that emphasize innovation and technology integration. United States wine production, centered primarily in California, represents approximately 10% of global output. American producers focus on varietal labeling and fruit-forward wine styles that appeal to international consumers seeking approachable wines with consistent quality.

Australian wine production has gained recognition for combining traditional winemaking knowledge with modern technology applications. Australian producers utilize advanced irrigation systems, temperature-controlled fermentation, and precision viticulture techniques to maximize grape quality and wine consistency. These technological innovations enable Australian wineries to compete effectively in global markets while maintaining cost efficiency.

Chilean wine production demonstrates how New World regions can achieve rapid quality improvements through strategic vineyard management and winemaking techniques. Chilean producers benefit from diverse microclimates that range from coastal influences to high-altitude growing conditions. This geographical diversity allows Chilean wineries to produce various wine styles while maintaining competitive pricing structures.

Argentine wine production centers on high-altitude vineyards that produce distinctive Malbec wines with intense color and concentrated flavors. Argentine producers have successfully positioned Malbec as a signature varietal, creating strong brand recognition in international markets. This focused approach to varietal branding exemplifies effective wine marketing strategies that emphasize regional identity and unique characteristics.

South African wine production combines Old World techniques with New World innovation, creating wines that reflect both European winemaking traditions and modern production methods. South African producers have developed unique blends that incorporate indigenous grape varieties with international varietals, creating distinctive products that stand out in global markets.

New Zealand wine production focuses on premium wine categories, particularly Sauvignon Blanc and Pinot Noir. New Zealand producers emphasize sustainable farming practices and minimal intervention winemaking techniques that preserve grape characteristics and terroir expression. This approach appeals to consumers who value authenticity and environmental responsibility in their wine choices.

The distinction between Old World and New World wine markets extends beyond production methods to encompass different approaches to wine distribution and consumer engagement. Old World producers often rely on established distribution networks and traditional marketing channels, while New World producers embrace direct-to-consumer marketing strategies and digital platforms to reach global audiences.

Old World wine regions emphasize heritage and tradition in their branding approaches, highlighting centuries of winemaking expertise and cultural significance. These regions often benefit from established reputations that command premium pricing and create strong consumer loyalty among wine enthusiasts who appreciate historical authenticity.

New World wine regions focus on innovation and accessibility in their marketing messages, emphasizing quality improvements and value propositions that attract new wine consumers. These regions often implement comprehensive wine tastings and events programs that educate consumers about wine appreciation and build brand awareness through experiential marketing.

Emerging Wine Regions

China has emerged as a significant force in global wine production, ranking among the top five producers worldwide. Chinese wine production reached 6.6 million hectoliters in 2024, representing substantial growth from previous years. Chinese producers have invested heavily in modern winemaking equipment and international consulting expertise to improve wine quality and establish credibility in domestic and international markets.

Chinese wine regions span diverse geographical areas from Xinjiang in the west to Shandong in the east, each offering unique growing conditions that influence wine characteristics. The Ningxia region has gained particular recognition for producing premium red wines that compete successfully in international wine competitions. Chinese producers are developing building a memorable wine brand strategies that combine traditional Chinese cultural elements with modern winemaking techniques.

Eastern European wine regions are experiencing renewed interest from international markets as quality improvements and competitive pricing create attractive value propositions. Romania produces approximately 3.2 million hectoliters annually, focusing on indigenous grape varieties that offer unique flavor profiles unavailable elsewhere. Romanian producers are implementing modern vineyard management techniques while preserving traditional winemaking methods that create distinctive products.

Bulgarian wine production has increased by 15% since 2022, with producers focusing on premium wine categories that command higher prices in export markets. Bulgarian wineries have established partnerships with international distributors to expand market reach and build brand recognition beyond domestic sales. These partnerships demonstrate effective wine distribution strategies that enable smaller producers to access global markets.

Hungary continues to rebuild its wine industry reputation through quality improvements and strategic marketing initiatives. Hungarian producers are rediscovering indigenous grape varieties and traditional winemaking techniques that create unique products with strong regional identity. The Tokaj region has maintained its reputation for producing exceptional dessert wines that command premium prices in international markets.

South American wine regions beyond Argentina and Chile are developing distinctive identities and market positions. Uruguay produces approximately 900,000 hectoliters annually, focusing on Tannat as a signature varietal that differentiates Uruguayan wines from other regional offerings. Uruguayan producers are implementing sustainable farming practices and artisanal winemaking techniques that appeal to environmentally conscious consumers.

Brazilian wine production has expanded significantly in recent years, with producers in the Serra Gaúcha region gaining recognition for sparkling wine production using traditional methods. Brazilian producers are developing unique wine styles that reflect tropical growing conditions and indigenous grape varieties, creating products that offer distinctive flavor profiles unavailable from traditional wine regions.

Peru has established itself as an emerging wine producer with vineyards located in high-altitude desert conditions that create unique growing environments. Peruvian producers are focusing on premium wine categories and sustainable farming practices that differentiate their products from mass-market offerings. These producers are implementing innovative marketing strategies that highlight the unique geographical conditions and cultural heritage of Peruvian wine regions.

Indian wine production continues to expand as domestic consumption increases and export opportunities develop. Indian producers in regions like Maharashtra and Karnataka are adapting international grape varieties to tropical growing conditions while developing indigenous varietals that reflect local terroir characteristics. Indian wineries are implementing modern production techniques and quality control systems that enable them to compete in international markets.

Lebanese wine production represents one of the oldest winemaking traditions globally, with producers combining ancient techniques with modern technology to create distinctive products. Lebanese wineries are positioned as premium producers that emphasize quality over quantity, targeting wine enthusiasts who value authenticity and historical significance. These producers are implementing sophisticated wine marketing strategies that highlight their unique cultural heritage and exceptional quality standards.

Canadian wine production has gained international recognition, particularly for ice wines produced in extreme cold conditions. Canadian producers in regions like British Columbia and Ontario are developing diverse wine portfolios that showcase the potential for quality wine production in northern climates. These producers are implementing innovative marketing approaches that emphasize the unique characteristics of Canadian wine regions and their distinctive products.

English wine production has expanded dramatically, with vineyard acreage increasing by 74% between 2018 and 2024. English producers are focusing on sparkling wine production using traditional methods, creating products that compete directly with Champagne in quality and prestige. English wineries are implementing sophisticated sensory branding strategies that emphasize the unique characteristics of English terroir and the precision of their winemaking techniques.

Japanese wine production combines traditional craftsmanship with modern precision, creating products that reflect Japanese attention to detail and quality. Japanese producers are developing unique wine styles using indigenous grape varieties and traditional fermentation techniques that create distinctive flavor profiles. These producers are implementing comprehensive quality control systems and premium positioning strategies that target discerning consumers who value exceptional craftsmanship.

Northern European wine regions are expanding as climate change creates more favorable growing conditions for grape cultivation. Countries like Denmark, Sweden, and Belgium are establishing commercial vineyards and developing wine industries that capitalize on changing environmental conditions. These emerging regions are implementing innovative growing techniques and marketing strategies that position them as pioneers in sustainable wine production.

The expansion of emerging wine regions demonstrates how global wine production continues to evolve in response to environmental changes, technological advances, and shifting consumer preferences. These regions are implementing diverse wine marketing strategies that emphasize their unique characteristics and competitive advantages while building credibility through quality improvements and strategic partnerships.

Emerging wine regions are utilizing digital marketing platforms and direct-to-consumer sales channels to reach global audiences without relying on traditional distribution networks. These producers are implementing comprehensive public relations for wineries programs that build awareness and credibility through media coverage, wine competitions, and industry recognition.

The success of emerging wine regions depends on their ability to differentiate their products while maintaining quality standards that meet international expectations. These regions are investing in modern winemaking equipment, international consulting expertise, and comprehensive marketing programs that build brand recognition and consumer loyalty.

Wine market trends indicate continued growth potential for emerging regions as consumers seek new experiences and unique products that offer value and authenticity. These regions are positioned to capitalize on growing demand for premium wines while implementing sustainable practices that appeal to environmentally conscious consumers.

The global expansion of wine production creates opportunities for emerging regions to establish distinctive market positions through innovative products, strategic marketing, and quality improvements that build long-term success in international markets.

Key Players and Market Leaders

The global wine market operates through a complex ecosystem where major corporations control significant market share while smaller producers carve out specialized niches. Revenue data from 2025 reveals distinct patterns among industry leaders, with top companies generating billions in annual sales through diverse strategies and market positioning.

Multinational Wine Corporations

Large-scale wine corporations dominate global markets through extensive distribution networks and diversified brand portfolios. The Wine Group leads the sector with $3.8 billion in revenue, focusing on affordable wines that appeal to mass-market consumers. Their strategy emphasizes volume production and cost-effective distribution channels across North American and international markets.

Treasury Wine Estates generates $3.5 billion annually through premium brand management and strategic acquisitions. The company operates across multiple continents, maintaining vineyard properties in Australia, California, and other key wine regions. Their portfolio includes luxury labels and mid-tier brands, allowing them to capture different market segments while building long-term consumer relationships.

Jackson Family Wines represents the family-owned multinational model, producing $2.9 billion in revenue through estate-grown wines and sustainable practices. The company emphasizes terroir-driven production while maintaining scale advantages through advanced farming techniques and modern winemaking technology. Their approach combines traditional winemaking methods with contemporary wine marketing strategies that highlight environmental stewardship.

Bronco Wine Company demonstrates the value-driven approach with $2.6 billion in revenue, primarily through brands like Charles Shaw. The company focuses on accessible pricing while maintaining quality standards, capturing price-conscious consumers who seek reliable wine options. Their distribution network spans major retail chains, making their products widely available across diverse consumer demographics.

E. & J. Gallo Winery, Constellation Brands Inc, and Accolade Wines round out the top multinational players, each employing distinct strategies for market dominance. Gallo emphasizes family heritage and American wine traditions, while Constellation Brands leverages its beverage industry expertise across wine, beer, and spirits categories. Accolade Wines focuses on international markets, particularly in Asia-Pacific regions where wine consumption continues expanding.

These corporations invest heavily in technology and automation to maintain production efficiency while managing quality across large volumes. Their research and development departments focus on consumer preferences, developing new products that align with emerging trends such as lower-alcohol wines, sustainable packaging, and premium positioning.

Multinational wine corporations utilize sophisticated wine distribution networks that span multiple countries and regions. They maintain relationships with major retailers, restaurants, and hospitality groups, ensuring consistent product availability across diverse markets. Their scale allows for significant marketing investments, including television advertising, digital campaigns, and sponsorship opportunities that smaller producers cannot match.

The strategic approach of these corporations includes vertical integration, where companies control multiple aspects of the supply chain from grape growing to retail distribution. This integration provides cost advantages and quality control while reducing dependency on external suppliers. Many corporations also engage in horizontal expansion, acquiring complementary brands or entering new geographic markets through partnerships and joint ventures.

Direct-to-consumer marketing represents a growing focus for multinational corporations, despite their traditional reliance on wholesale distribution. These companies develop sophisticated e-commerce platforms and wine club programs that create direct relationships with consumers. They leverage customer data to personalize marketing messages and product recommendations, enhancing customer retention and lifetime value.

Sustainability initiatives have become central to multinational wine corporation strategies, driven by both regulatory requirements and consumer demand. Companies invest in renewable energy systems, water conservation technologies, and organic farming practices across their vineyard operations. These investments often require significant capital but provide long-term benefits through cost savings and brand differentiation.

Public relations for wineries plays a crucial role in multinational corporation strategies, as these companies must manage brand reputation across multiple markets and consumer segments. They employ professional public relations teams that handle media relationships, crisis communication, and industry positioning. Their public relations efforts often focus on corporate social responsibility initiatives, environmental stewardship, and community engagement programs.

Boutique and Craft Wineries

Boutique and craft wineries represent the artisanal segment of the wine industry, appealing particularly to Millennials and Gen Z consumers who prioritize authenticity and sustainability. These smaller producers typically operate on much smaller scales than multinational corporations but command premium pricing through specialized positioning and unique product offerings.

Craft wineries emphasize biodynamic and regenerative agriculture practices that appeal to environmentally conscious consumers. Their production methods often involve traditional techniques combined with modern precision, creating wines that reflect specific terroir characteristics and winemaker artistry. These producers frequently highlight their farming practices, vineyard locations, and winemaking philosophy as central elements of their brand identity.

Natural wine production has emerged as a significant trend among boutique wineries, with producers minimizing chemical interventions during grape growing and winemaking processes. This approach resonates with health-conscious consumers and those seeking authentic, minimally processed products. Natural wine producers often emphasize transparency in their production methods and ingredient sourcing.

Boutique wineries excel at building memorable wine brands through storytelling and personal connections with consumers. They leverage their smaller size to create intimate experiences, whether through tasting room visits, winemaker dinners, or vineyard tours. These experiences build emotional connections that translate into customer loyalty and word-of-mouth marketing.

Wine tastings and events form the cornerstone of boutique winery marketing strategies. Unlike large corporations that rely heavily on mass marketing, craft producers focus on experiential marketing that allows consumers to interact directly with winemakers and vineyard staff. These events create opportunities for education about winemaking processes, terroir characteristics, and food pairing suggestions.

Digital engagement strategies for boutique wineries often emphasize social media platforms where they can share behind-the-scenes content, harvest updates, and winemaker stories. These authentic communications help build community around the brand while showcasing the human elements of wine production. Many craft wineries use Instagram and Facebook to document seasonal vineyard activities and new wine releases.

Sensory branding becomes particularly important for boutique wineries as they seek to differentiate their products in crowded markets. They focus on creating distinctive packaging, label designs, and tasting experiences that reinforce their brand identity. Many craft producers invest in unique bottle designs, premium corks, and artistic labels that reflect their winemaking philosophy and target market preferences.

Direct-to-consumer sales channels provide boutique wineries with higher profit margins compared to wholesale distribution. These producers often develop wine club programs, online sales platforms, and tasting room retail operations that capture full retail value. Direct sales also provide valuable customer data that helps wineries understand consumer preferences and purchasing patterns.

Boutique wineries often specialize in specific grape varieties or winemaking styles that reflect their regional characteristics or winemaker expertise. This specialization allows them to become recognized experts in particular wine categories, building reputation and credibility within their market niche. Some focus on indigenous grape varieties, while others explore innovative winemaking techniques that create unique flavor profiles.

The craft wine segment benefits from growing consumer interest in provenance and authenticity. Younger consumers increasingly seek products with clear origin stories and transparent production methods. Boutique wineries capitalize on this trend by providing detailed information about their farming practices, harvest dates, and production techniques.

Wine market trends favor boutique producers in several key areas. Premium pricing acceptance has grown among consumers willing to pay higher prices for quality and authenticity. Sustainability concerns drive demand for organic and biodynamic wines. Limited production creates scarcity value that appeals to collectors and enthusiasts seeking unique wines.

How PR builds credibility for winemakers becomes particularly important for boutique producers who lack the marketing budgets of large corporations. They rely on earned media through wine critics, industry publications, and influencer partnerships to build brand awareness and credibility. Many craft wineries participate in wine competitions and industry events to gain recognition and third-party validation.

Boutique wineries often form cooperative relationships with other small producers to share resources, knowledge, and marketing opportunities. These collaborations might include joint marketing events, shared distribution arrangements, or cooperative purchasing of equipment and supplies. Such partnerships help small producers achieve economies of scale while maintaining their independent identity.

Innovation in boutique winemaking often involves experimental techniques, unusual grape varieties, or unique aging processes that distinguish their products from mass-market offerings. These innovations frequently become talking points that generate media attention and consumer interest. Some craft producers experiment with alternative aging vessels, wild fermentation, or blending techniques that create distinctive wine profiles.

The relationship between boutique wineries and their local communities often becomes a significant marketing advantage. These producers frequently source from local suppliers, employ local workers, and participate in community events that build goodwill and brand recognition. Their local connections often translate into loyal customer bases and positive word-of-mouth marketing.

Quality control in boutique wineries relies heavily on hands-on attention and smaller batch sizes that allow for careful monitoring throughout the production process. This attention to detail often results in wines that reflect the winemaker’s vision and skill, creating products that stand out in blind tastings and wine competitions. The personal involvement of owners and winemakers in daily operations ensures consistency and quality across their limited production runs.

Wine Industry Trends and Innovations

The wine industry experiences transformative changes that reshape production methods and consumer engagement across global markets. Emerging technologies converge with traditional winemaking practices while sustainability initiatives drive fundamental shifts in vineyard management and marketing approaches.

Sustainable and Organic Wine Production

Environmental consciousness transforms wine production practices as consumers increasingly prioritize ecological responsibility in their purchasing decisions. Organic wine production now represents 7.8% of global wine production, with annual growth rates exceeding 12% across major wine regions. This expansion reflects consumer demand for wines produced without synthetic pesticides, herbicides, or artificial additives.

Biodynamic farming principles gain traction among premium wineries, incorporating lunar cycles and holistic vineyard management systems. Demeter International certifies over 900 wineries worldwide using biodynamic methods, demonstrating the practice’s growing acceptance among quality-focused producers. These farms treat vineyards as complete ecosystems, using preparations like fermented herbal extracts and composted cow manure to enhance soil health and vine vitality.

Regenerative agriculture practices extend beyond organic certification requirements, focusing on carbon sequestration and biodiversity enhancement. Vineyards implementing cover crops, composting programs, and reduced tillage report 15-30% improvements in soil organic matter within three growing seasons. These methods create resilient vineyard ecosystems that withstand climate variability while producing grapes with enhanced flavor complexity.

Water conservation technologies address critical resource management challenges across wine regions experiencing drought conditions. Precision irrigation systems using soil moisture sensors reduce water consumption by 25-40% compared to traditional watering methods. Drip irrigation combined with deficit irrigation strategies concentrates grape flavors while minimizing environmental impact, particularly valuable in regions like California’s Central Coast and Australia’s Murray-Darling Basin.

Carbon footprint reduction initiatives encompass packaging innovations and supply chain optimization. Lightweight glass bottles reduce transportation emissions by 8-12% per shipment, while alternative packaging formats like bag-in-box systems decrease carbon footprints by up to 84% compared to traditional bottles. Several major producers commit to carbon neutrality by 2030, implementing renewable energy systems and purchasing carbon offsets for unavoidable emissions.

Vineyard biodiversity programs create habitat corridors supporting beneficial insects and wildlife populations that naturally control pest species. Integrated pest management systems reduce chemical inputs by 60-80% while maintaining grape quality standards. Native plant restoration projects along vineyard borders provide nesting sites for raptors and insectary plants that support predatory mites and parasitic wasps.

Sustainable packaging extends beyond bottles to include labels, closures, and shipping materials. Recycled paper labels, natural cork alternatives, and compostable shipping inserts align with environmentally conscious brand positioning. These materials communicate sustainability values while maintaining product protection and aesthetic appeal essential for premium wine marketing.

Energy efficiency improvements through solar installations, geothermal cooling systems, and LED lighting reduce operational costs while demonstrating environmental commitment. Wineries implementing comprehensive energy management systems report 30-50% reductions in electricity consumption, with payback periods averaging 3-5 years through utility savings and tax incentives.

Soil health monitoring using advanced testing methods guides fertilization decisions and organic matter enhancement strategies. Mycorrhizal fungi inoculants improve nutrient uptake efficiency while beneficial bacteria cultures enhance soil structure and water retention capacity. These biological approaches reduce synthetic fertilizer requirements by 40-60% while maintaining or improving grape quality parameters.

Waste reduction programs encompass pomace utilization, wastewater treatment, and packaging minimization. Grape pomace becomes compost, animal feed, or distilled spirits ingredients, diverting organic waste from landfills. Constructed wetlands treat winery wastewater naturally while creating attractive landscapes that enhance visitor experiences during wine tastings and events.

Technology Integration in Winemaking

Digital transformation revolutionizes traditional winemaking processes through precision viticulture, data analytics, and automated quality control systems. Smart vineyard technologies generate detailed datasets that inform harvest timing, irrigation scheduling, and disease prevention strategies with unprecedented accuracy.

Drone technology equipped with multispectral cameras maps vineyard health conditions, identifying stressed vines, nutrient deficiencies, and disease pressure before visual symptoms appear. These aerial surveys cover 100-acre vineyards in 45 minutes, generating prescription maps for targeted interventions that optimize grape quality while minimizing input costs. Machine learning algorithms analyze spectral data patterns to predict harvest dates within 3-5 day windows, enabling precise harvest scheduling that maximizes fruit quality.

Internet of Things sensors throughout vineyards monitor soil moisture, temperature, humidity, and leaf wetness in real-time. This continuous data collection enables precise irrigation scheduling that maintains optimal vine stress levels for flavor concentration while preventing water waste. Weather stations integrated with disease prediction models trigger preventive treatments only when conditions favor pathogen development, reducing fungicide applications by 30-40%.

Fermentation monitoring systems track temperature, density, and chemical parameters continuously throughout the winemaking process. Automated sampling and analysis equipment provides hourly updates on sugar consumption, alcohol production, and malolactic fermentation progress. This real-time monitoring enables winemakers to intervene precisely when needed, ensuring consistent quality across multiple fermentation tanks.

Artificial intelligence applications analyze historical production data, weather patterns, and market trends to optimize vineyard management decisions. Machine learning models predict optimal blend ratios, aging requirements, and release timing based on sensory evaluation data and consumer preference patterns. These systems process thousands of variables simultaneously, identifying subtle correlations that human analysis might miss.

Robotic harvesting systems address labor shortages while maintaining gentle fruit handling standards. Advanced robotic pickers use computer vision to identify ripe clusters and pneumatic systems to remove grapes without damaging vines. These machines operate continuously during optimal harvest windows, reducing labor costs by 15-25% while ensuring consistent fruit selection criteria.

Blockchain technology creates immutable records of wine production, from grape harvesting through bottling and distribution. These digital certificates provide consumers with complete traceability information, including vineyard location, harvest date, fermentation details, and storage conditions. Anti-counterfeiting applications protect premium brands from fraud while enabling direct authentication through smartphone apps.

Quality control laboratories implement automated testing systems that analyze chemical parameters, sensory characteristics, and microbiological safety within hours rather than days. High-throughput liquid chromatography systems process dozens of samples simultaneously, identifying flavor compounds, preservative levels, and potential contaminants with laboratory-grade precision. These rapid testing capabilities enable immediate adjustments during production processes.

Direct-to-consumer marketing platforms integrate customer relationship management systems with inventory management and shipping logistics. Personalized recommendation engines analyze purchase history, tasting notes, and preference surveys to suggest wines matching individual consumer profiles. These systems increase customer retention rates by 25-35% while improving average order values through targeted product recommendations.

Digital cellar management systems track inventory levels, aging requirements, and quality assessments across thousands of barrels and tanks. Radio frequency identification tags monitor location, movement, and tasting evaluations for each wine lot throughout production and aging processes. This comprehensive tracking enables precise quality control and efficient cellar operations that minimize handling costs.

Virtual reality applications enhance wine tastings and events by creating immersive vineyard experiences for remote participants. Consumers can virtually walk through vineyards, observe harvest activities, and interact with winemakers while tasting wines at home. These technologies expand market reach beyond traditional geographic limitations while providing engaging educational experiences that build memorable wine brands.

Predictive analytics models analyze consumer behavior patterns, seasonal demand fluctuations, and market trends to optimize production planning and inventory management. These systems process point-of-sale data, social media engagement metrics, and economic indicators to forecast demand for specific wine styles and price points. Accurate demand predictions reduce inventory carrying costs while preventing stockouts during peak selling periods.

Advanced spectroscopy techniques enable non-destructive quality assessment of grapes and wines throughout production processes. Near-infrared spectroscopy systems analyze sugar content, acidity levels, and phenolic compounds in seconds without sample preparation. These rapid assessment tools guide harvest decisions and blending choices with scientific precision that enhances wine quality consistency.

Building a memorable wine brand through technology involves sophisticated customer data analysis and personalized marketing campaigns. Wine marketing strategies incorporate geofencing technology to target consumers near retail locations, while augmented reality labels provide interactive experiences that differentiate products on crowded shelves. These technological innovations create engaging touchpoints that strengthen brand relationships and encourage repeat purchases.

Temperature and humidity control systems in production facilities and storage areas maintain optimal conditions automatically, reducing human error and ensuring consistent wine quality. Smart climate control systems adjust environmental parameters based on wine style requirements and external weather conditions. These automated systems reduce energy consumption by 20-30% while protecting wine investments from temperature fluctuations that could compromise quality.

Economic Impact and Market Analysis

The American wine industry generated $323.55 billion in total economic activity during 2025, establishing itself as a formidable economic force that extends far beyond vineyard operations. This massive economic output encompasses production, distribution, sales, and consumption activities that benefit numerous sectors throughout the economy.

Global Wine Trade Statistics

The United States wine industry operates within a global framework that includes 10,761 wine producers managing 763,080 vineyard acres across the nation. These producers contribute significantly to international trade flows, with the domestic market serving as both a major consumer and producer in global wine commerce. The industry’s substantial scale positions it as a key player in worldwide wine markets, where trade patterns continue to evolve based on consumer preferences and regional production capabilities.

Export activities from American wine regions contribute to the broader economic impact through foreign currency earnings and international brand recognition. Import operations simultaneously support domestic distributors, retailers, and hospitality businesses that serve diverse wine portfolios to consumers. The interconnected nature of global wine trade means that American producers benefit from both domestic consumption and international market opportunities.

Wine distribution networks span multiple tiers, from producers to wholesalers to retailers, creating economic value at each level. These distribution systems support employment across transportation, warehousing, and retail sectors while facilitating market access for producers of all sizes. The complexity of wine distribution requires specialized knowledge and infrastructure that generates additional economic activity beyond basic production operations.

International wine exhibitions, trade shows, and professional tastings create platforms for market expansion and knowledge exchange. These events generate economic activity through travel, hospitality, and professional services while facilitating business relationships that drive future trade volumes. American wine regions frequently participate in these global forums to establish market presence and develop export opportunities.

The digital transformation of wine commerce has expanded global trade opportunities through e-commerce platforms and direct-to-consumer marketing channels. Online sales platforms enable smaller producers to access international markets previously dominated by large distributors, while consumers gain access to a broader range of wine options. This technological evolution continues to reshape traditional trade patterns and create new economic opportunities.

Wine market trends indicate growing demand for premium products in emerging markets, creating export opportunities for American producers. Consumer preferences for authentic, story-driven brands align with the marketing capabilities of many American wine regions that emphasize terroir, sustainability, and craftsmanship. These positioning strategies help American wines compete effectively in international markets where consumers increasingly value quality over quantity.

Trade regulations and international agreements significantly impact wine commerce patterns, with tariffs, labeling requirements, and import procedures affecting market access and pricing strategies. American wine producers must navigate these regulatory environments while maintaining quality standards and competitive positioning. Changes in trade policies can quickly alter market dynamics and influence strategic planning for wine businesses.

Regional specialization within American wine production creates distinct export profiles, with different areas focusing on specific varietals or wine styles that appeal to particular international markets. California Cabernet Sauvignon, Oregon Pinot Noir, and Washington Riesling represent examples of regional specializations that have gained international recognition. This specialization approach enables American producers to compete effectively against established international wine regions.

Consumer Spending Patterns

American consumers demonstrate sophisticated spending patterns that reflect evolving preferences and demographic shifts within the wine market. The premium wine segment shows particular strength, with consumers increasingly willing to pay higher prices for wines that offer exceptional quality, unique stories, or sustainable production methods. This trend toward premiumization drives revenue growth even as overall volume sales face pressure from demographic changes.

Wine tourism represents a significant component of consumer spending, generating $14.13 billion in tourist expenditures through 74 million visitor trips to wine regions. These visits combine wine purchases with hospitality experiences, creating multiple revenue streams for producers and supporting local economies. Wine tastings and events serve as primary drivers of tourism, with consumers seeking authentic experiences that connect them directly with producers and wine regions.

Demographic analysis reveals that aging Baby Boomers, traditionally the largest wine-consuming group, are reducing their consumption levels, creating challenges for overall market growth. However, Millennials and Generation Z consumers are developing different purchasing behaviors that emphasize quality over quantity, sustainability, and authentic brand stories. These younger consumers prefer wines from producers who demonstrate environmental responsibility and social consciousness.

Direct-to-consumer marketing has become increasingly important as consumers seek personalized experiences and exclusive access to limited-production wines. Wine clubs, online sales platforms, and cellar door purchases enable producers to build direct relationships with consumers while capturing higher margins than traditional wholesale distribution. This approach allows producers to tell their stories directly and create emotional connections that drive customer loyalty.

Sensory branding plays a crucial role in consumer decision-making, with packaging design, tasting room experiences, and brand storytelling influencing purchase decisions. Consumers increasingly value wines that offer memorable experiences beyond just taste, including attractive packaging, compelling origin stories, and connections to specific places or people. Building a memorable wine brand requires consistent messaging across all consumer touchpoints, from vineyard visits to online interactions.

Restaurant and hospitality sector spending represents a substantial portion of wine consumption, with establishments ranging from casual dining to fine dining driving significant volume sales. Wine by-the-glass programs have expanded consumer exposure to diverse wine styles while generating higher margins for restaurants. Professional sommelier programs and wine education initiatives help drive consumer interest in exploring new wine regions and styles.

E-commerce platforms have transformed wine purchasing patterns, particularly following the acceleration of online shopping during recent years. Consumers appreciate the convenience of home delivery and access to wines not available in local retail stores. Online wine sales enable consumers to research products thoroughly, read reviews, and access detailed producer information before making purchasing decisions.

Seasonal spending patterns show distinct peaks during holiday periods and summer months, with consumers purchasing wines for entertaining and gift-giving. Wine marketing strategies must account for these seasonal variations while building year-round engagement through wine club memberships, educational content, and special events. Understanding these patterns helps producers manage inventory and cash flow while maximizing revenue opportunities.

Price sensitivity varies significantly across consumer segments, with value-conscious buyers seeking quality wines at moderate prices while luxury consumers focus on exclusivity and prestige. Successful wine brands often develop portfolio strategies that address multiple price points while maintaining brand integrity. This approach allows producers to capture different consumer segments while building long-term brand loyalty.

The rise of wine subscription services and curated wine selections reflects consumer desire for discovery and education. These services provide consumers with regular wine deliveries featuring selections from different regions or producers, often accompanied by educational materials and tasting notes. This model creates recurring revenue streams for wine businesses while exposing consumers to wines they might not otherwise encounter.

Social media influence has become increasingly important in shaping consumer wine choices, with younger consumers particularly responsive to recommendations from wine influencers and peer reviews. Public relations for wineries now includes digital marketing strategies that engage consumers through social media platforms, virtual tastings, and online wine communities. These digital touchpoints create opportunities for authentic engagement and brand building.

Consumer education initiatives, including wine classes, certification programs, and guided tastings, drive increased spending by building consumer confidence and appreciation for wine quality. Educated consumers typically purchase higher-priced wines and explore diverse wine styles, creating opportunities for producers to introduce new products and command premium pricing. Wine education also builds long-term customer relationships that support sustained spending patterns.

The economic impact of consumer spending extends beyond direct wine purchases to include related products and services such as wine accessories, storage solutions, and wine-focused travel experiences. These ancillary spending categories contribute additional economic value while creating opportunities for wine businesses to expand their revenue streams. Understanding these broader spending patterns helps wine producers develop comprehensive business strategies that maximize economic impact.

Health consciousness among consumers has influenced wine consumption patterns, with some consumers reducing alcohol consumption while others seek wines made with minimal chemical inputs. Organic and biodynamic wines appeal to health-conscious consumers willing to pay premium prices for products aligned with their values. This trend creates opportunities for producers who invest in sustainable farming practices and can effectively communicate their environmental stewardship.

Challenges Facing the Wine Industry

The wine industry confronts a complex web of obstacles in 2025, from environmental disruptions to regulatory constraints that reshape production dynamics and market access. Post-pandemic production increases have created surplus inventory across multiple price tiers, forcing producers to implement strategic adjustments while navigating an increasingly unpredictable business environment.

Climate Change Effects

Rising global temperatures and erratic weather patterns are fundamentally altering grape cultivation regions worldwide. Spain’s devastating floods in late 2024 destroyed thousands of hectares of vineyards, while North Carolina’s hurricane damage eliminated entire harvest seasons for dozens of producers. These events represent more than isolated incidents—they signal a systematic shift that’s reshaping where and how wine gets produced.

Temperature increases of 2-3 degrees Celsius across traditional wine regions have pushed harvest dates forward by 15-20 days compared to historical averages. Burgundy producers now harvest Pinot Noir in August rather than September, while Australian vineyards face unprecedented heat stress that damages grape quality before harvest. The effects extend beyond timing adjustments—they’re forcing fundamental changes in varietal selection and vineyard management practices.

Water scarcity affects 60% of global wine regions, with California’s Central Valley experiencing groundwater depletion rates that threaten long-term viability. Portuguese producers report drilling wells to depths exceeding 200 meters, compared to 50 meters just a decade ago. These conditions force difficult decisions about irrigation investments versus relocating production to more sustainable locations.

Smaller producers face disproportionate challenges adapting to climate disruptions. While large corporations can redistribute production across multiple regions or invest in climate-controlled facilities, family-owned wineries often lack the capital for significant infrastructure changes. A 50-acre family vineyard in Oregon might need $300,000 for frost protection systems, representing years of profit margins in an already tight market.

Collaborative sustainability initiatives are emerging as essential survival strategies. The Porto Protocol unites 70+ wine companies across 12 countries, sharing climate adaptation techniques and funding joint research projects. These partnerships enable smaller producers to access technologies and knowledge previously available only to major corporations. Participants report 25% reductions in water usage and 15% decreases in carbon emissions through shared best practices.

Consumer education about eco-friendly practices has become integral to brand positioning and long-term market viability. Producers emphasize organic certification, carbon-neutral shipping, and regenerative agriculture practices in their marketing messages. Survey data indicates 73% of millennials factor environmental impact into wine purchasing decisions, creating market pressure for sustainable production methods.

The economic impact of climate adaptation extends throughout the supply chain. Insurance premiums for vineyard properties have increased 40% since 2022, while specialized equipment for extreme weather protection adds significant operational costs. Some regions are experiencing fundamental shifts in varietal suitability—Champagne houses are experimenting with heat-resistant grape varieties, while traditional Bordeaux blends require new approaches to maintain quality standards.

Heat stress affects not only grape quality but also fermentation processes and aging requirements. Higher alcohol levels result from accelerated sugar accumulation, forcing winemakers to adjust techniques for achieving balanced flavor profiles. Storage facilities require enhanced climate control systems, adding infrastructure costs that smaller producers struggle to absorb.

Emerging wine regions are gaining prominence as traditional areas face climate challenges. English sparkling wine production has expanded 300% since 2020, benefiting from warming temperatures that make grape cultivation viable in previously unsuitable locations. Similarly, Scandinavian countries are developing wine industries as climate conditions become favorable for certain grape varieties.

Regulatory and Trade Barriers

Tariff structures create cascading effects throughout wine distribution networks, particularly impacting premium wine segments priced above $100 per bottle. U.S. tariffs on European wines range from 25% to 100% depending on country of origin and alcohol content, directly translating to higher retail prices that reduce consumer accessibility. French wine imports decreased 18% following recent tariff implementations, while domestic producers struggle with increased production costs from imported equipment and materials.

Capital costs for domestic producers have risen substantially due to regulatory compliance requirements and trade barriers on essential equipment. Stainless steel tanks from European manufacturers face 15% tariffs, while specialized bottling equipment sees even higher rates. These costs particularly burden smaller wineries that lack economies of scale—a typical 10,000-case winery might pay an additional $75,000 annually for tariff-affected equipment and materials.

Wholesaler purchasing patterns reflect growing conservatism driven by inflation concerns and interest rate impacts. Three-tier distribution systems amplify these effects, as wholesalers reduce inventory purchases by 12% compared to pre-pandemic levels. This conservatism creates cash flow challenges for producers dependent on predictable order volumes, forcing many to extend payment terms or offer additional discounts to maintain relationships.

Off-premise sales channels face particular pressure as retailers demand longer payment terms and higher promotional support. Grocery chains are requiring 90-day payment terms instead of traditional 30-day periods, while expecting increased promotional allowances to maintain shelf space. These changes strain working capital for wine producers, especially those without diversified sales channels.

Interstate shipping regulations create additional complexity for direct-to-consumer marketing strategies. Only 44 states allow direct wine shipments, with varying restrictions on quantities, licensing requirements, and tax obligations. Navigating these regulations requires specialized legal expertise that costs smaller producers $15,000-$25,000 annually in compliance fees and administrative overhead.

International market access faces increasing bureaucratic hurdles as countries implement stricter labeling requirements and certification processes. China’s new import regulations require additional testing procedures that add 45-60 days to shipping timelines, while European Union organic certification demands documentation that smaller producers find difficult to maintain. These requirements effectively limit market access for producers lacking dedicated export departments.

Alcohol taxation policies vary dramatically across jurisdictions, creating pricing inconsistencies that distort market dynamics. Excise taxes on wine range from $0.20 per gallon in Wyoming to $2.50 per gallon in Alaska, affecting retail pricing strategies and distribution decisions. Producers must navigate these variations while maintaining consistent brand positioning across different markets.

Environmental regulations are becoming more stringent, requiring significant compliance investments. California’s new water usage reporting requirements mandate monthly monitoring and documentation, while pesticide restrictions eliminate traditional pest management options. These regulations protect environmental resources but create additional operational costs and complexity for producers.

Labor regulations add another layer of complexity, particularly for seasonal harvesting operations. H-2A visa processing delays average 75 days, forcing producers to plan harvest labor months in advance without certainty about availability. Minimum wage increases across wine-producing states have raised harvest costs by 25-30% since 2022, pressuring profit margins throughout the production cycle.

Export documentation requirements have become increasingly complex, with many countries demanding enhanced traceability information and certified translations. The European Union’s new digital passport requirements for imported wines add $500-$800 per shipment in administrative costs, while reducing processing speeds at customs facilities.

Trade agreements affect wine producers differently based on their size and target markets. Small producers often lack the resources to navigate complex trade agreement provisions, while larger corporations can optimize their supply chains to take advantage of preferential treatment. The United States-Mexico-Canada Agreement provides benefits for North American producers, but implementation requires specialized knowledge that many smaller wineries cannot afford.

Banking regulations impact wine industry financing, as many financial institutions classify wine inventory as high-risk assets. This classification increases borrowing costs and reduces available credit lines, particularly affecting producers with significant aging inventory. Alternative financing sources charge premium rates, adding financial pressure during cash flow challenges.

Quality control regulations vary significantly between domestic and international markets, requiring producers to maintain multiple certification systems simultaneously. Organic certification alone requires separate documentation for USDA, European Union, and individual country standards, creating administrative burdens that consume significant management time and resources.

The regulatory environment continues evolving as governments balance industry protection with consumer safety and environmental concerns. Producers must anticipate future changes while managing current compliance requirements, creating strategic planning challenges that affect investment decisions and long-term viability. Success requires dedicated resources for regulatory monitoring and compliance management that smaller producers often cannot provide.

Future Outlook for Wine Markets

The global wine market stands at $385 billion in 2023, with projections indicating substantial expansion to $528.3 billion by 2030. This growth trajectory represents a compound annual growth rate of 4.6%, signaling robust market confidence despite facing various challenges throughout the supply chain.

Global Market Expansion Patterns

Still wine segments dominate the projected growth, with forecasts showing expansion to $273.7 billion by 2030 at a 4.5% CAGR. Sparkling wine demonstrates stronger momentum with a 4.9% CAGR over the same period, reflecting shifting consumer preferences toward celebratory and premium offerings. Europe maintains its position as the wine industry’s central hub, though significant expansion opportunities emerge in markets outside traditional European strongholds.

Wine marketing strategies evolve alongside these growth patterns, with producers increasingly focusing on regions experiencing the strongest expansion rates. Asia-Pacific markets show particular promise, driven by rising disposable incomes and growing wine culture adoption among younger demographics. South American markets also demonstrate strong potential, especially in countries where local wine production intersects with international export opportunities.

Consumer behavior shifts create new market dynamics that influence growth projections. Health-conscious trends impact certain segments, while premium wine demand continues expanding. Direct-to-consumer marketing channels gain importance as producers seek higher margins and closer customer relationships. These distribution changes affect how growth materializes across different market tiers.

Climate factors introduce uncertainty into global wine market expansion. Extreme weather events affect grape production yields, creating supply constraints that influence pricing and availability. Producers adapt through technological innovations and geographic diversification, but climate adaptation costs impact overall market profitability.

Counterfeit wine issues pose challenges to market growth, particularly in emerging regions where regulatory frameworks remain underdeveloped. Authentication technologies and blockchain solutions emerge as tools to protect brand integrity and consumer confidence. These protective measures require investment but prove essential for sustainable market expansion.

United States Wine Market Dynamics

The U.S. wine market demonstrates exceptional growth potential with projections indicating 8.1% CAGR from 2025 to 2030. This expansion rate significantly exceeds global averages, positioning the United States as a primary driver of worldwide wine industry growth. Market size projections reach $118.35 billion by 2030, representing substantial increases from current levels.

Sparkling wine segments within the U.S. market show even stronger growth potential at 9.2% CAGR through 2030. This acceleration reflects American consumer preferences for premium experiences and celebration-focused wine consumption. Producers recognize these trends through increased investment in sparkling wine production capabilities and specialized wine marketing strategies tailored to these segments.